Stronachs LLP has once again been shortlisted in the Private Client Team of the Year category at the Scottish Legal Awards 2025.

Stronachs has recognised the growth and contribution of team members across several departments in its latest round of promotions – reinforcing its commitment to developing talent and supporting long-term career progression.

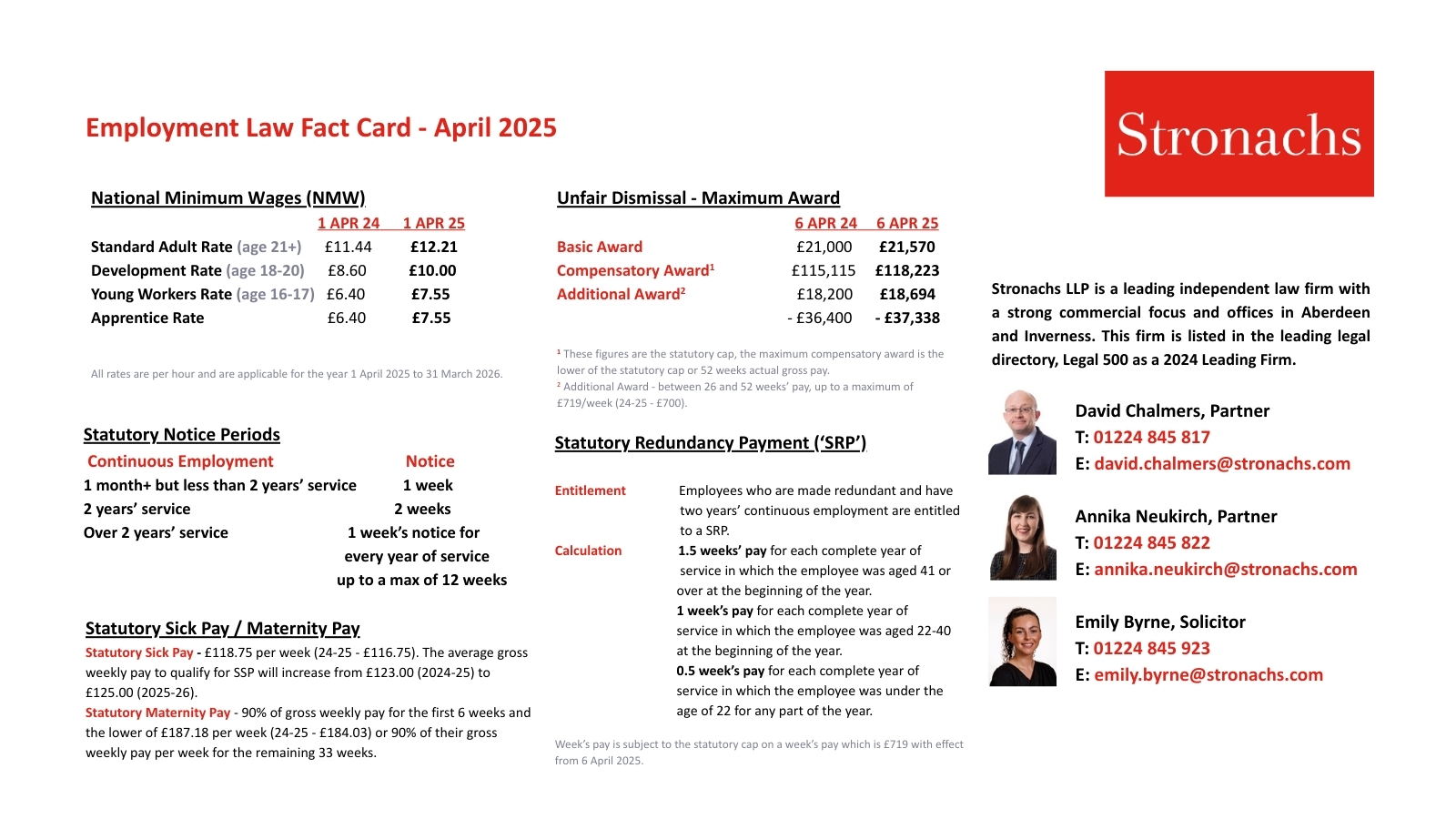

The government has announced changes to the rates and limits for 2025. The Employment Rights (Increase of Limits) Order contains the full list of increases. View the Employment Law Fact Card to learn more about a number of the key changes coming into force in April 2025.

Stronachs LLP has announced its festive opening hours for 2024/25.

Stronachs LLP is thrilled to announce that Jaclyn Russell, partner and head of its private client team has been named a finalist in the ‘Solicitor of the Year’ category at The Herald Law Awards of Scotland 2024.

Stronachs LLP has pledged its support to the Young Person’s Guarantee (YPG).

Continued success for Stronachs as top corporate lawyer recognised alongside others and firm ranked across several key practice areas.

Stronachs LLP has enhanced its employment team with the announcement of the assumption of a new partner and the engagement of a new employment lawyer.